Profit Calculator: Karura Crowdloan VS Staking Kusama

- James Agenda

- Aug 10, 2021

- 5 min read

Updated: Aug 13, 2021

Hello, friends! This is James Agenda here.

Kusama just finished its 5th Parachain Auction!

We are now moving towards the First Parachain Auction on Polkadot!

Many people are starting to ask:

What is better: To Stake your DOT tokens or to use them on Crowdloans for Parachain Auctions?

In truth, It's impossible to predict what is better.

But we can indeed estimate it!

And a good way to do it is by looking at Kusama, especially at its first Crowdloan (won by Karura).

After all, what happened at Kusama is substantial evidence of what is likely to occur at Polkadot.

For me it was 410% more profitable to Crowdloan Karura vs Stake KSM!

Unbelievable!

So, let's take a look at my results on Karura's Croawdloan and comparing them with my results Staking KSM.

But first, here is a brief overview of Staking & Crowdloan's aspects.

Staking DOT and KSM

🤑 Staking Returns %

By Staking DOT or KSM tokens, my Staking Rewards were, on average between 12% to 15% APY, depending on which platform I used to stake.

⏳ Staking Liquidity

When Staking DOT, you need to wait 28 days if you want to transfer your DOT tokens to another account.

When Staking KSM, you need to wait 7 days.

You can have instant liquidity if you Stake Polkadot on Kraken.

But remember that when using Kraken you are giving up custody of your tokens.

⚠️ Staking Risks

When Staking, especially if you don't choose good validators, you may suffer from slashing.

🌐 Ecosystem's Contribution from Staking

When you Stake your DOT and/or KSM tokens, you are helping to secure Polkadot's and/or Kusama's network.

By Staking, you are indirectly helping validating trasactions that happens on the blockchain!

Making an analogy with Bitcoin blockchain:

It's like if you were an investor that lends money to a miner (Bitcoin's blockchain validator) for him to invest in his operation.

You then receive interests based on the miner's performance, proportionally on the borrowed amount.

But in Polkadot, that happens in a safer and more elegant arrangement since the validator ("miner") never has custody of your money.

Crowdloan

🤑 Crowdloan Returns %

On Crowdloan, your returns are determined by the project you chose to support.

For example:

Karura rewarded crowdloaners with ~23.5 KAR tokens for each 1 KSM crowdloaned.

Moonriver rewarded ~14.5 MOVR for each 1 KSM crowdloaned.

⏳Crowdloan Liquidity

When you participate in a Crowdloan, your DOT or KSM tokens are locked during the Parachain Auction.

If your chosen project wins the auction, your tokens will remain locked until Parachain's leasing period finishes.

On Polkadot, the maximum leasing period is 24 month.

On Kusama, the maximum leasing period is 48 weeks.

If you participate in a Crowdloan at Polkadot Blockchain, you may be unable to transfer your DOT tokens for 2 years!

⚠️ Crowdloan Risks

Different from Staking, you have no risk on your crowdloaned funds.

And you always keep custody of your funds. No one can touch it!

Your funds remain linked to your address and will return when Parachain's leasing period finishes.

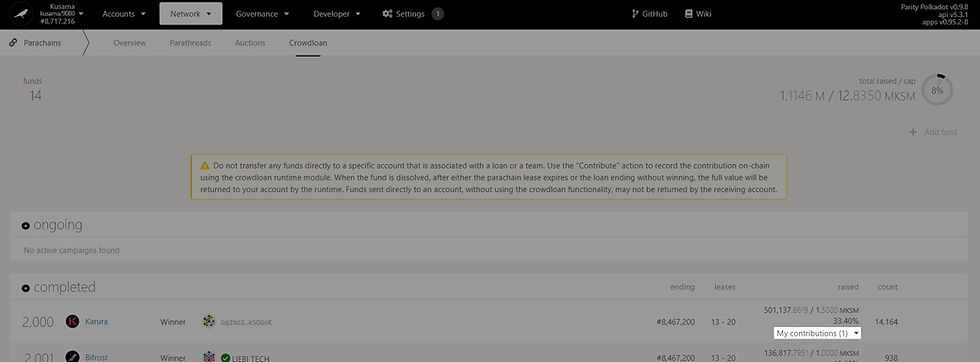

You may check your crowdloaned tokens at the blockchain anytime on Polkadot.JS:

However, there is a possible disadvantage: the opportunity cost.

If you use funds to Crowdloan a winner project, you can't transfer them and neither receive Staking Rewards during the leasing period.

For example,

Suppose you have 2 accounts: Account A and Account B.

You use Account A for Staking 100 DOT, for 24 months.

You use Account B for Crowdloan 100 DOT for "Project XYZ", for 24 months, expecting to receive "1000 XYZ tokens".

After 24 months,

You'll have at Account A 100 DOT + 24 DOT.

You'll have at Account B: 100 DOT + 1000 "XYZ tokens".

Also, when crowdloaning, you may lose other opportunities to use your tokens since they are locked.

For example, you may want to sell your tokens at the "Bullrun's top" and then buy back on the bear market.

Or maybe you want to sell your tokens to buy a house in a special offer and further DCA back to crypto.

In both cases, it wouldn't be possible to use your crowdloaned tokens until the end of the Parachain Slot Leasing.

🌐 Ecosystem's Contribution from Crowdloan

When you participate in a crowdloan, you are helping the Ecosystem to expand on good projects.

In ANY blockchain, resources are limited.

Every Parachain Auction is the opportunity for the community to say: "We should allocate some of the blockchain's resources in this specific path".

Crowdloan VS Staking

First, I would like to say that I don't endorse deciding to Crowdloand or to Stake based only on the financial returns.

I do both Stake and participate in Crowdloans, despite which one seems to be more profitable.

And, as I explained before:

Besides financial returns, Staking and Crowdloan have different liquidity, risks and purposes.

I intend to keep mitigating risks and spreading my contribution to the ecosystem by splitting my funds on Crowdloand and Stake

That been said, I indeed recommend a profit comparison to decide on how to split your funds into both options.

My Results on Karura Crowdloan VS Staking Kusama

Since Crowdloan and Staking have different aspects, I did a simplified comparison.

First, suppose this example,

In Account A, I staked 1 KSM.

In Account B, I participated in Karura's Crowdloan with 1 KSM.

Now that Karura won the parachain auction, I have on Account B: 1 KSM + 23.5 KAR.

But I can transfer only 7 KAR. The others 16.5 KAR are going to be unlocked during the 48 weeks.

Also during the next 48 weeks, I will likely have on Account A: 1 KSM + 0.144 KSM from Staking Rewards.

What is more valuable: Mine partially locked 23.5 KAR tokens or mine 0.144 KSM tokens?

Well, I can't trade them for dollars (and neither any other asset) today, so it's hard to compare.

To simplify, I applied a Liquidity Discount on the Locked KAR and a Present Value Discount for KSM tokens.

After this, I now consider them tradable.

Those discounts are completely arbitrary.

You can estimate your KAR liquidity discount by asking yourself these 2 questions:

If you could, what would be the lowest price that you'd sell your locked KAR right now?

If you could buy Locked KAR, what is the maximum price that you'd pay right now?

You can estimate KSM Present Value discount by asking yourself this question:

If you are offered to sign a contract that locks your KSM for 48 weeks, without staking rewards, how much would you charge for signing it?

In my personal case, I'm calculating using:

KSM Present Value discount = 5%

KAR liquidity discount = 10%

So, using these discounts in the example:

At Account A, I would have made:

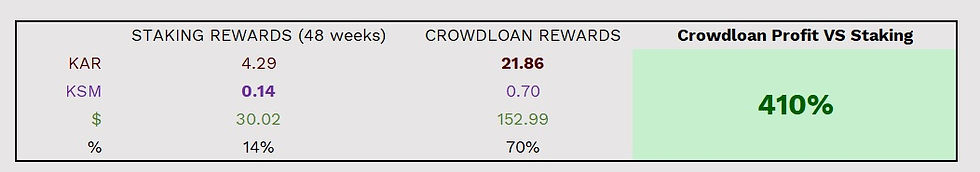

0,144 Staking Rewards KSM = 220$ * 0.144 * (100- 5%) = $30.02

At Account B, I would have made:

7 KAR + 16.5 lockedKAR = $7 *[ 7 + 16.5 * (100%-10%)] = $152.99

So $153 vs. $30! Or 0.7 KSM vs 0.14 KSM! Or 21.86 KAR vs 4.29 KAR!

410% more profitable!

You may download the calculator to run your own simulation, changing the discounts and/or other parameters:

Let me know if you agree or not with my results! I appreciate your feedback!

Also, consider subscribing for free to keep yourself informed on Polkadot & Kusama ecosystem!

Cheers!

Comments